Hi, my name is Cristina Lowe, and we are going to be finishing up your financial disclosure. So, if you remember, we have FL 140, this is the FL 141, and you have 142 and 150. So you should have already completed 140, 142, and 150, and this is kind of the document that wraps it up. And it is the world'’s longest title, and Donald;#39’t get scared by it — stamp;#39’s actually a very easy form, but stamp;#39’s a horrible name. So stamp;#39’s called the quot;Declaration Regarding Service of Declaration of Disclosure and Income and Expense Declaration". Okay, so lamp;#39’s check on the box, and lamp;#39’s take you to the top. Very, very familiar by now — it is absolutely 100% standard, you'’re going to fill in the name, and we are going to use this from the petitioner'’s point of view. So we have John Smith, and John Smith'’s address is 124 Rose Street, and San Ramon, California, 94582. And revamp;#39’re going to put down his phone number, which is 415.442.5577, and we Donald;#39’t need a fax number, we Donald;#39’t need an email address because revamp;#39’re in Contra Costa County, but we are going to put quot;in pro Pequot;, meaning he is self-represented (or you are self-represented), or quot;in Peoria persona" would be the other way to put it. So, again, we are in the county of Contra Costa. The address for the court is 751 Pine Street. The mailing address is PO Box 911. The city and zip code would be Martinez, California, 94544. Camp;#39’m sorry, tatami;#39’s 94553. And the branch name is the Peter L. Spinet ta Family Law Center. So by now, you'’ve already been down to the courthouse — you should be very familiar with that glass building. Hopefully you haven'’t had to make too many trips. So the petitioner is going to be John...

PDF editing your way

Complete or edit your the 1023 form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 1023 ez instructions directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your the instructions 1023 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your form 1023 ez instructions by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Instructions 1023-EZ

About Form Instructions 1023-EZ

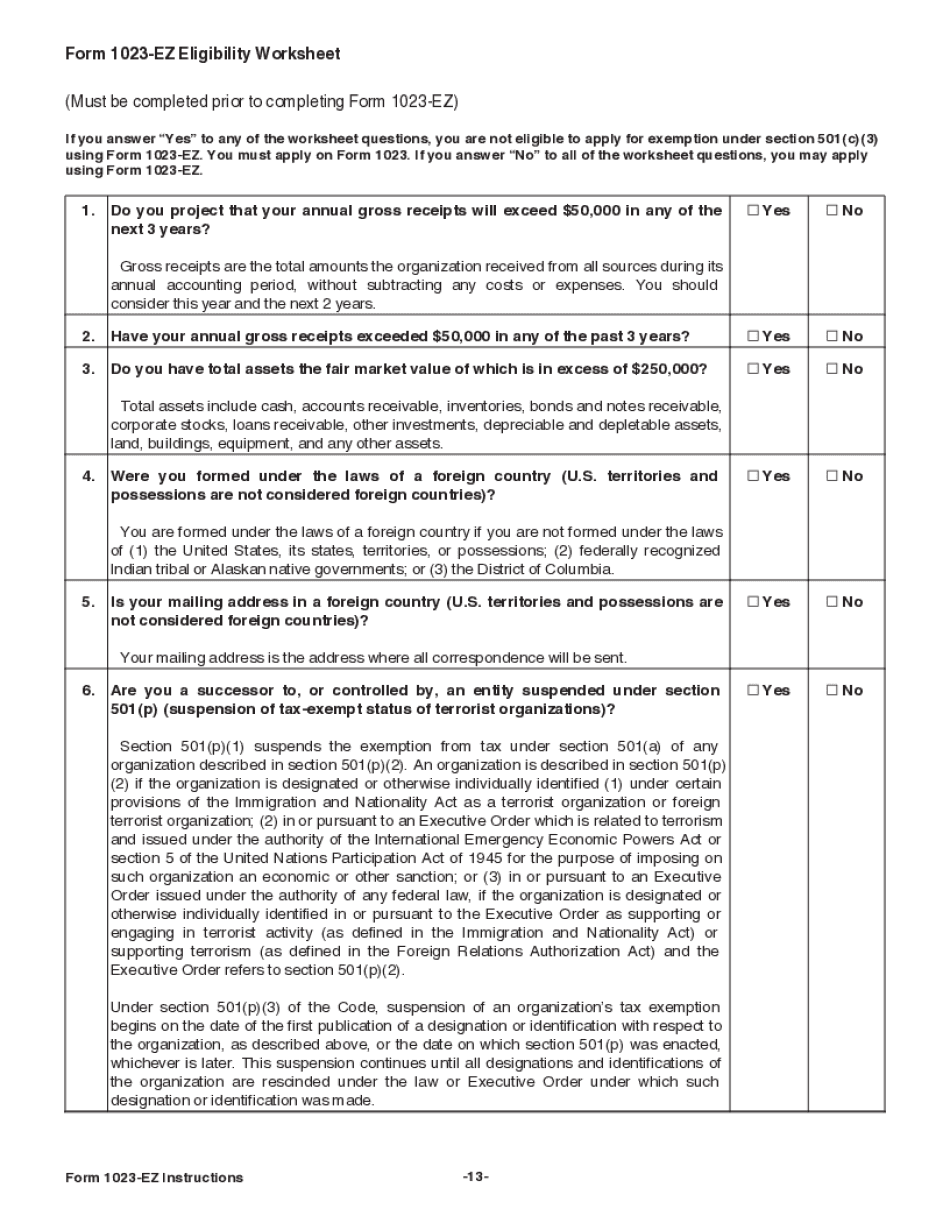

Form 1023-EZ is a simplified version of the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. It is issued by the Internal Revenue Service (IRS) of the United States and is used by organizations seeking tax-exempt status under this section. The Form 1023-EZ is specifically designed for small nonprofit organizations that meet certain criteria, making it easier and quicker to apply for tax-exempt status compared to the regular Form 1023. By using this simplified form, eligible organizations can save time and effort in completing the application process. To qualify for the Form 1023-EZ, organizations must have projected annual gross receipts not exceeding $50,000 for the first three years and total assets not exceeding $250,000. They should also belong to specific categories, such as religious, educational, charitable, scientific, literary, or public safety organizations. This simplified form is ideal for newly formed nonprofit organizations or small-scale nonprofits that meet the eligibility criteria. Its streamlined process enables such organizations to gain tax-exempt status more efficiently and focus on their mission and activities rather than navigating complex paperwork.

What Is 1023 Ez Instructions?

Online solutions assist you to organize your file administration and increase the productiveness of your workflow. Look through the quick manual to be able to fill out Form 1023 Ez Instructions?, prevent errors and furnish it in a timely way:

How to fill out a Form 1023 Ez Instructions?

-

On the website with the blank, press Start Now and pass towards the editor.

-

Use the clues to complete the appropriate fields.

-

Include your personal details and contact details.

-

Make certain that you choose to enter true data and numbers in suitable fields.

-

Carefully verify the written content in the form so as grammar and spelling.

-

Refer to Help section if you have any questions or contact our Support staff.

-

Put an digital signature on your Form 1023 Ez Instructions? printable with the help of Sign Tool.

-

Once blank is done, press Done.

-

Distribute the ready form by means of email or fax, print it out or download on your gadget.

PDF editor enables you to make adjustments in your Form 1023 Ez Instructions? Fill Online from any internet linked gadget, personalize it in keeping with your requirements, sign it electronically and distribute in different approaches.

What people say about us

Become independent with digital forms

Video instructions and help with filling out and completing Form Instructions 1023-EZ