Award-winning PDF software

Form Instructions 1023-EZ for Tallahassee Florida: What You Should Know

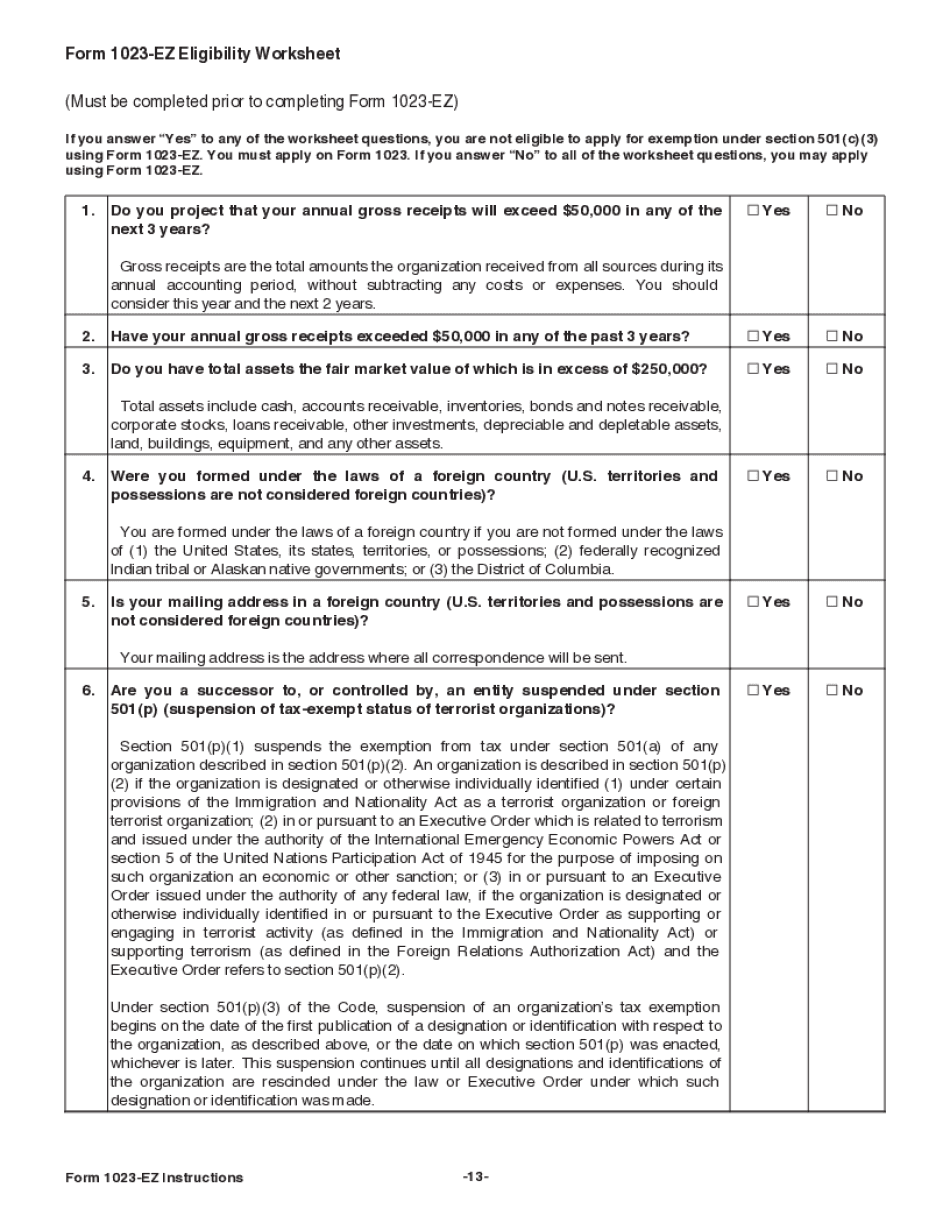

January 2018). The purpose of the Streamlined Application for Recognition of Exemption is to encourage organizations that are not for profit or that do not have significant net assets, to seek recognition of exempt status from the government via the filing of Form 1023-EZ. The filing of a Form 1023-EZ with the Internal Revenue Service (IRS) allows nonprofit organizations that qualify to receive recognition of exemption from federal income tax under section 501(c)(3), which is the section that relates to tax-exempt organizations except public charities. Public charity status is not an appropriate tax status for individuals that receive income solely from a private foundation, nonprofit corporation, or other organization. Form 1023-EZ requires two-parts: Form 1023 (to qualify), and the IRS Form 1023e-Z (to file to seek recognition of your tax-exempt status). Both Forms 1023 are due to the IRS on the third day after you begin your non-profit operation. To apply for recognition of tax-exempt status under Section 501(c)(3), organizations must follow these four steps: You must file a Form 1023 for recognition of your tax-exempt status. If your organization qualifies for tax exemption by filing Form 1023, the IRS will send you a Notice of Assessment of the tax-exempt status of your organization which you must file in accordance with section 6701 of the Internal Revenue Code. A taxpayer may file for recognition of tax status only in a state, city, or town where the taxpayer is incorporated. Therefore, you must seek recognition based on the IRS Form 1023, which is called the Federal Organization Identification Number of the nonprofit organization, not your state's or municipal code, or by form of incorporation as defined in section 530. What is included with “Nonprofit” The term “Nonprofit” means a nonprofit organization or any person formed by and for the benefit of a nonprofit organization. The term “nonprofit organization” includes the following organizations. Income tax-exempt organization: A corporation, trust, estate, or similar entity that has been established (or any person organized or existing under any power of attorney under a constitution or bylaws which purports to create or create liabilities) as an exempt person, or which is otherwise recognized as an exempt organization by a state, or that has filed an assessment for tax exemption, and that meets all requirements for maintaining its status in an exempt organization.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Instructions 1023-EZ for Tallahassee Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form Instructions 1023-EZ for Tallahassee Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Instructions 1023-EZ for Tallahassee Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Instructions 1023-EZ for Tallahassee Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.