Award-winning PDF software

Fort Worth Texas online Form Instructions 1023-EZ: What You Should Know

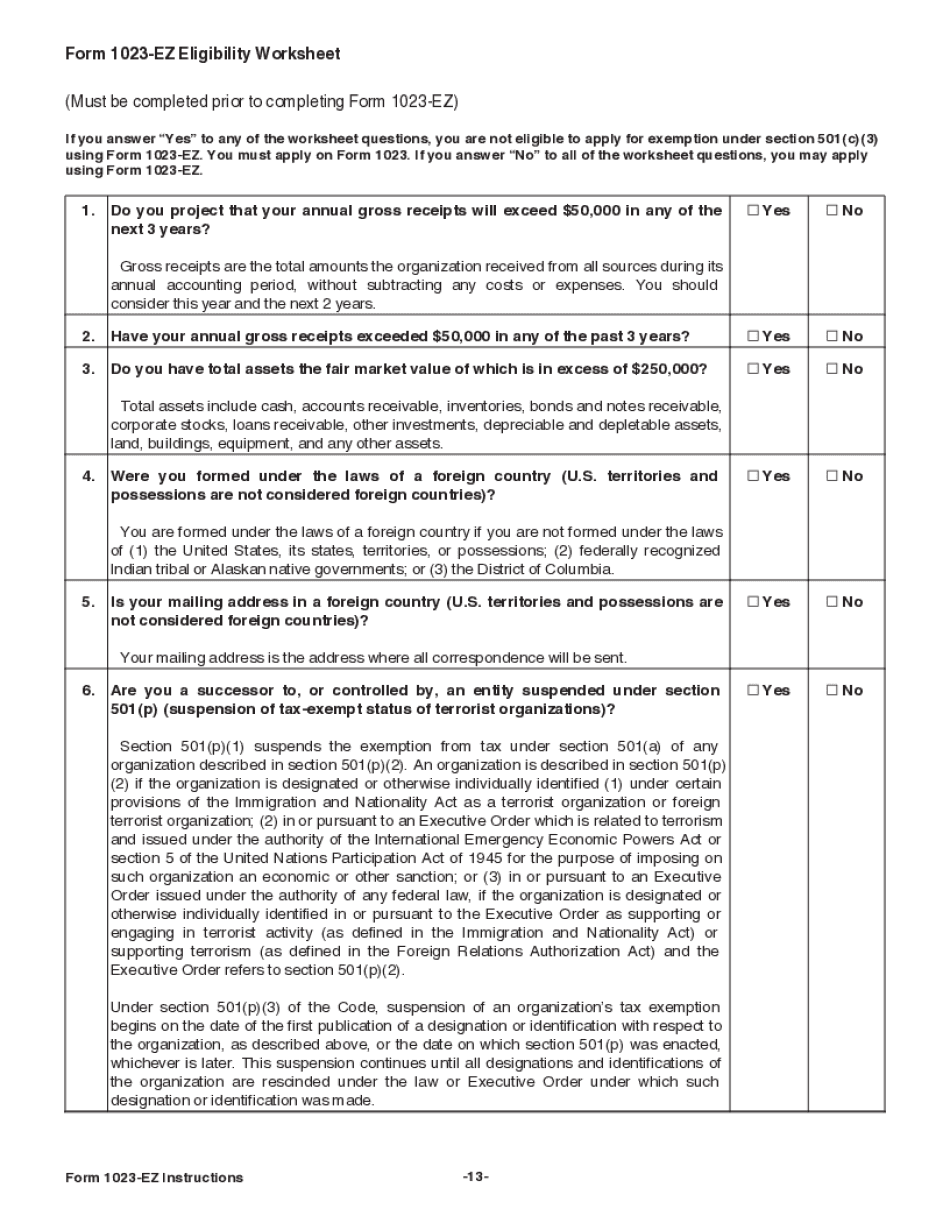

We want to help you save time and money through our advice, information, resources, and free training for potential nonprofits. If you have any questions, we are available to answer your questions in the comments. If you're preparing for IRS Form 1023-EZ, read the instructions, and follow the instructions carefully. This guide is not written to assist you with IRS Form 1023-EZ; that application is for other small organizations that want to seek recognition of their exempt status. Before completing IRS Form 1023-EZ, you'll need to decide whether to form an exempt nonprofit organization and, if so, how large it should be. Some small organizations may be able to form as few as two people or as many as 100. Other small organizations may require more staff or equipment. To prepare the IRS Form 1023-EZ, you or your attorney should review the following information. What type of organization do you want to form? Who will run the organization? What will your organization do? Where will your office be located? How will your organization benefit the public? Tax exemption can help nonprofits do some things that corporations can't. For instance, an organization with tax- exempt status is allowed to: Pursue its charitable, religious, civic, fraternal, educational, literary, scientific, testing for public safety and health, or public welfare purposes. Operate and manage a national cemetery, national memorial, or park system or maintain and operate a national natural history museum. Make charitable contributions of property, labor, or services without incurring interest or payment of a profit or gain. In addition, an organization with tax-exempt status under section 501(c)(3) is allowed to: Receive gifts, bequests, bequests in kind, and bequests in kind contributions (charitable gifts) from private individuals without imposing any limitations on what it may accept. Invest the funds it receives only for charitable purposes. Furnish free or reduced-price admission to the public to a public park, museum, or similar institution. Under the federal Internal Revenue Code (IRC) and other federal tax laws, any organization eligible for tax exemption from the federal government is entitled to nonprofit tax exemptions under section 501(c)(3). 501(c)(3) corporations are also entitled to the same benefits under section 501.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Fort Worth Texas online Form Instructions 1023-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a Fort Worth Texas online Form Instructions 1023-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Fort Worth Texas online Form Instructions 1023-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Fort Worth Texas online Form Instructions 1023-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.